What is Withholding Tax (WHT)? Do we need to pay tax if making payments to non-tax residents?

What Is Withholding Tax (WHT) ?

What is Withholding Tax (WHT)? As a Malaysian taxpayer, do I need to pay attention to this issue? If you notice the current era, you will find that the era of making profits from price differences has slowly become a thing of the past. Now, we are in the era of traffic. In order to increase traffic, we will start to move our business online and conduct online transactions to gain more traffic. The more traffic we get, the more "eyeballs" we win, the higher the exposure, and the easier it is to sell products. To increase traffic, the most basic step we take is to advertise online to increase the exposure of our products.

When we do business using foreign platforms or advertise on foreign platforms (such as Facebook/Google), we must pay attention to the issue of withholding tax. Withholding tax is a broad topic, and there are 9 major categories of income that are subject to withholding tax. Therefore, here we will only focus on the two major categories of income that require payment of withholding tax.

When we make payments to foreign companies, we must pay attention to the issue of withholding tax, because any income (from foreign companies, which is the money we pay to foreign companies) may belong to the Special Classes of Income under Section 4A of the Income Tax Act 1967, and a portion of the money must be retained and paid to the tax authority (according to Sections 109 and 109B of the Income Tax Act 1967).

Why We Need To Submit Withholding Tax?

Simply put, our government has adopted a tax system to collect a portion of taxes from every foreign company that earns money in our country. This is done to prevent our currency from leaking out and to collect a portion of money from every transaction made in our country. The question is, why has a tax system that applies to actions taken against foreign companies evolved into an issue that we need to pay attention to and pay ourselves?

For Example;

If I advertise on F's foreign social media platform and top up RM 1,000 to F as advertising fees, F issues a bill and receipt for RM 1,000. However, according to Section 109 of the Income Tax Act 1967, F, the foreign company, needs to pay a 10% withholding tax to our tax authority.

From the perspective of the foreign company, they would not only charge RM 900, but they would also withhold the 10% withholding tax of RM 100 and remit it to our tax authority. If we want to deduct this expense from our income, we must help the non-resident company submit this 10% fee, and ultimately we will have to bear this cost ourselves.

Withholding Tax Rate

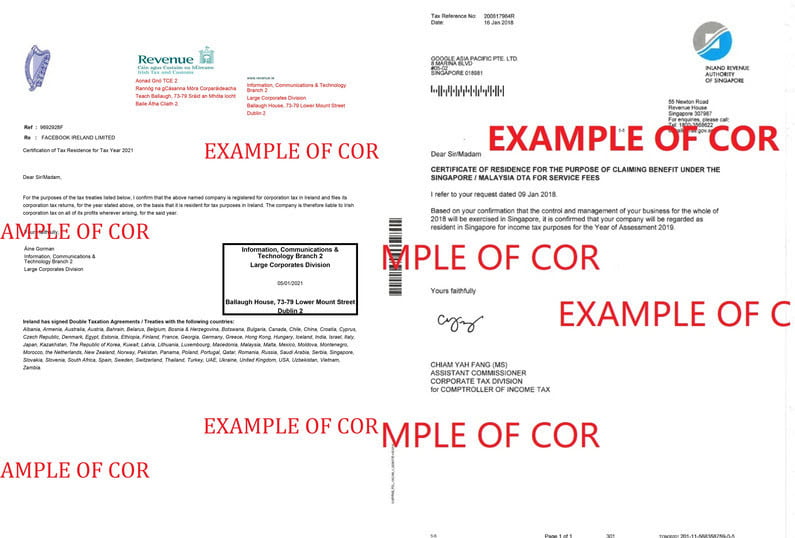

According to the law, a 10% withholding tax rate applies to all Special classes of income or Royalty payments. However, Malaysia has signed Avoidance of Double Taxation agreements with many countries. If a foreign company has a Certificate of Residence (COR) to prove that it is a legitimate and registered business, they may be eligible for a lower withholding tax rate based on the Avoidance of Double Taxation agreements.

When reporting to the Malaysian Inland Revenue Board, we must attach the counterparty's Certificate of Residence (COR) to enjoy a reduced withholding tax rate of 8%. Otherwise, we must pay the withholding tax of 10% according to the law. Malaysia has signed Avoidance of Double Taxation agreements with approximately 47 countries to date, and discussions are ongoing with approximately 34 countries.

Royalty

Royalty refers to the fee paid to the licensor when we are authorized to use someone else's property. Most of these are intangible assets, such as copyrights, design drawings, other people's design rights, trademarks, and other intangible asset rights such as other people's videos.

The most common example is when we purchase or use an application to create our own advertisements, we need to pay withholding tax. Royalty is also referred to as copyright fees. When we pay to use some social media companies as platforms to promote our own products or advertise for ourselves, we need to pay withholding tax to the tax bureau according to Section 109. The most common platforms are Google or Facebook.

We must pay a 10% withholding tax when using Google or Facebook to advertise. When we have their Certificate of Residence (COR) to prove that they are a foreign legal taxpayer, we can pay withholding tax at a lower rate under the DTA (8%).

Special Classes Of Income

When we pay fees to foreign companies, some service fees will be classified as special category income (income of the other party). For example, if we use online services of certain foreign platforms to rent out our real estate to customers, the foreign platform only charges us commission and fees. If it can be proven that the service is provided in Malaysia, then according to Section 4A (ii) of the Income Tax Act 1976, these commissions and fees will be classified as special category income and withholding tax must be paid under Section 109B.

From 6 September 2017, if it can be proven that the service is not provided in Malaysia, we will not need to pay withholding tax.

Withholding Tax Payment

So when do we need to pay withholding tax? The payer needs to submit the withholding tax to the tax authority on the day of payment or one month after the day of successful remittance to the non-resident. If the last day of the month falls on a holiday or weekend, for example, if the last day falls on a Friday holiday or weekend, the next working day will become the last day.

If the payer fails to pay the withholding tax within 30 days, a penalty of 10% of the unpaid withholding tax will be imposed. In addition, the expenses paid by us to the non-resident payee will not be allowed for tax deduction! In other words, if we fail to pay withholding tax on these expenses, they cannot be treated as business expenses and cannot be used to deduct the money we earn.

How do I make payment?

First of all, we need to prepare :

- Invoice or bill that paid for foreigner

2. Proof of payment (date, time and total amount)

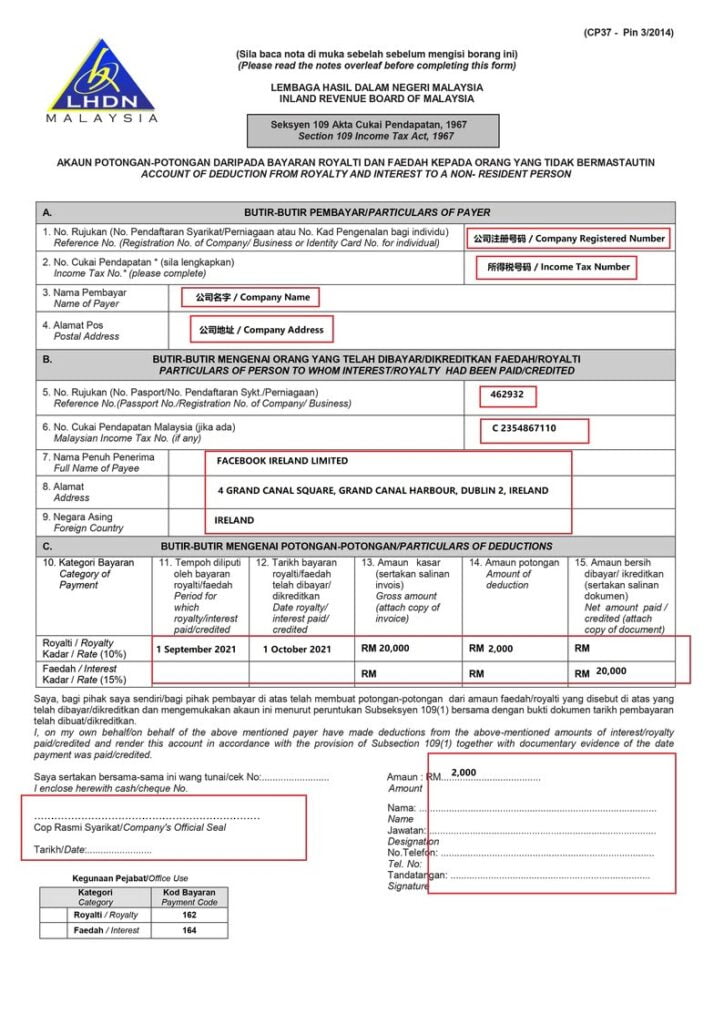

Form that filled up ( Royalty – Form CP 37, Special Classes Of Income – Form CP 37D)

Submit to Inland Revenue Board Malaysia

Note that for each payment that requires withholding tax, a form must be filled out. If there are 10 bills, then 10 forms must be filled out and arranged according to the order of form > bill > payment proof.

How To Fill Up CP 37

- C11 is the month in which payment has been made to the foreign platform company.

- C12 is the month in which withholding tax will be paid (30 days later).

- C13 is the total amount paid.

- C14 is 10% of the withholding tax; C13 x 10%.

- C15 has the same amount as C13.

Once everything is filled out, we can prepare cash or a check to submit along with all the documents to the tax office.

Cawangan Duta

Ground Floor, Block 8A

Government Office Complex

Jalan Duta, 50600 Kuala Lumpur

We can also make the payment through a bank transfer to:

Ketua Pengarah Hasil Dalam Negeri

8000766957

CIMB Bank

After completing the transfer, we can email helpttpayment@hasil.gov.my

all the documents and payment receipts to them, and then wait for them to send us the official receipt.

Although not all payments to non-residents require withholding tax, we must be aware of this issue when making payments to foreign companies. This withholding tax is not a new regulation, but many people choose to ignore or neglect it.

免责声明 : 此文章的内容为通用信息,仅供参考学习,不应该被认为税艺风云提供任何的专用建议与服务。在您公司或任何个人财产采取任何决定或决策或行动前,需要求专业咨询。因此文章的内容引起任何的损失,税艺风云将不对该公司或个人或他人负任何责任。

关注税艺风云 Telegram 追踪消息 Click Me

Like and Follow 我们的脸书更多内容 Click Me

If the content needs to be modified or updated, pleaseContact Us.