How Do I Submit My Personal Tax As An Employee?

First time declare income tax? What do I do?

Understand Your Income Sources

First of all, we should understand the type of our income source. As an employee, we get our salary paid monthly. This is category as employment income under Section 4 (b) of Income Tax Act 1967 and we need to declare Form BE to Inland Revenue Board Malaysia.

Due Date Of Form BE Return Form

Form BE will due on every30th April. If you did not submit your income tax return form in time, penalty will be imposed. Government also give us extra15 days (15th May)to submit our income tax return form. In short, we are required to submit and settle everything before 15th May including income tax payable payment.

Preparation

Before submiting our income tax return form, we should get two things prepared on our hand.

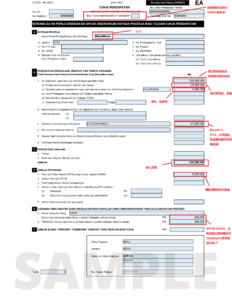

- Our FORM EA

- Tax relief documents (If any)

What? Wait a second, how come it's involved so many forms and all form sounds the same? Yes, once something is related to money, it will become complex. Form EA is a "summary statement" for your annual salary in a company. Usually we pronounce as "EA Form". Such form was prepared by your HR Department or Admin. This is because as early as March, your company was submitted a Form E to Inland Revenue Board Malaysia (IRB). So we may request our Form EA from our HR Department.

If you quit your job mid-year, you may request your Form EA from your ex-company during next year income tax declaration.

Next, we should get our tax relief documents prepared. For instance, our insurance premium statement, official receipt of our lifestyle relief, medical checkup official receipt and etc.We are required to keep sufficient records for a period of SEVEN years.This is because we have to prepare our documentation and related prove when income tax officer tax audit us.

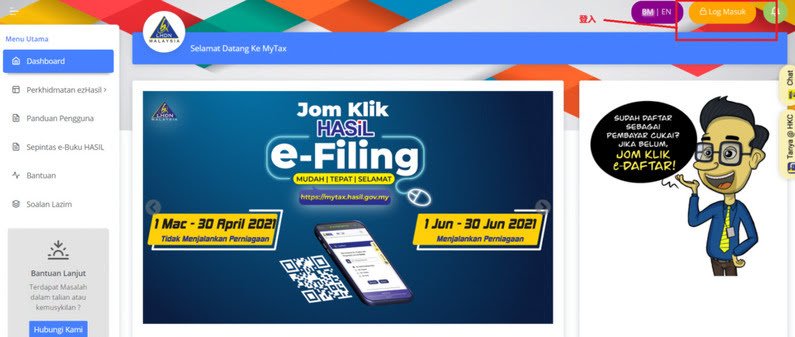

1. Register Our Form BE

First of all, we need a online IRB account to register our income tax return form. If you do not have any online account, you may referhow to register your online e-filing account.

For those have an online account, login via :https://bit.ly/3wG6jxl

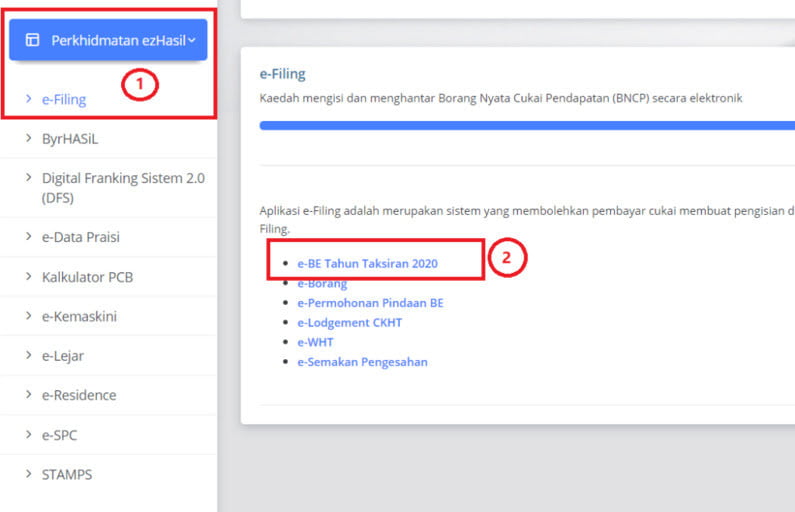

After login, refer to menu at left hand side,

✔ 1. Click "Perkhidmatan ezHasil"

✔ Select e-filing

✔2. Select e-BE Tahun Taksiran 2020, your form will be pop up and it's registered.

2. Fill In Your Form BE

填入你的个人资料,这里就不一个一个解释了,如果遇到什么不明白的可以联络我们,我会尽量回答帮助。change the language to English on top right bar.

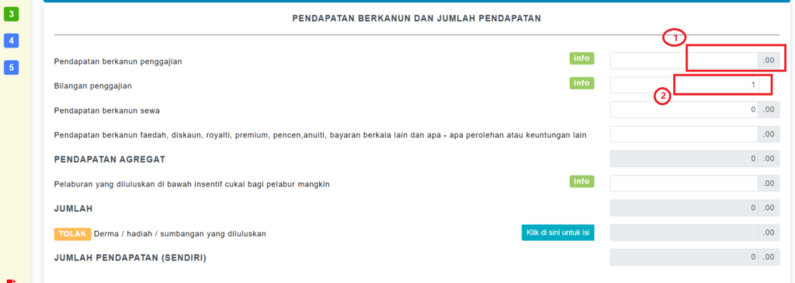

✔ 1. Fill in you personal information, you should fill in your income according to your FORM EA

✔ 2. Fill in your employment quantity. If you only have one job, fill in "1" if you got 3 jobs, fill in "3"

Please fill in your bank account detail properly so that they able to return our deducted PCB without any issue.

For the PCB column & CP 500, usually it will calculate automatically, if your figure was not popped up, we may fill in manually according to your FORM EA.

3. Tax Relief (Tax Deduction)

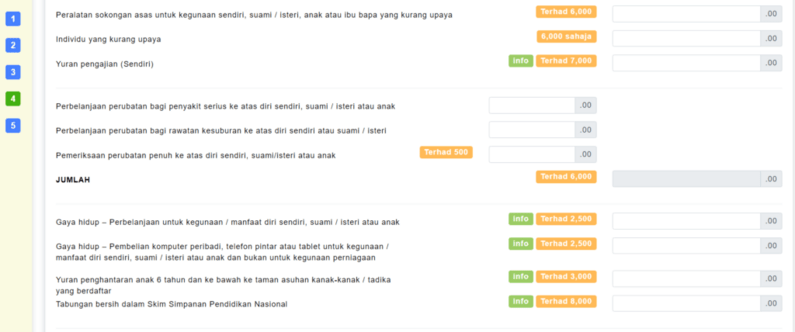

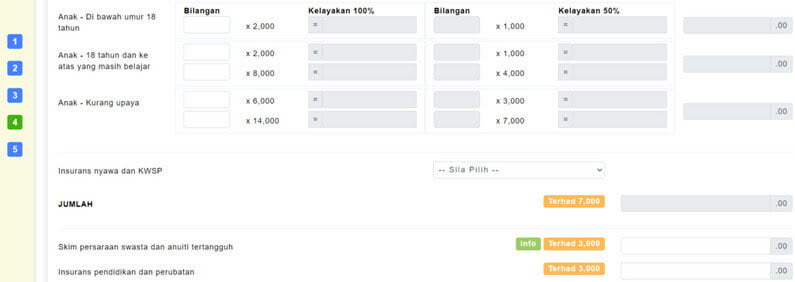

After filling in your employment income, we will need to fill in our tax relief. Tax relief is very important for employees. This is because tax relief is the only one way to reduce our tax pay for majority employees.

If you like to do tax planning, you may refer Tax Relieffor more understanding

4. Check Your Form BE

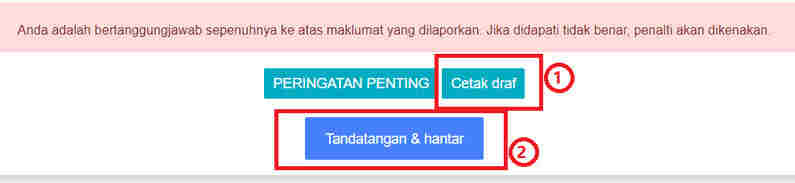

When you finish everything, remember to click "Cetak Draft / Print Draft“ to double check your form and make sure everything is correct and accurate.

✔ 1. Remember check your draft version form !

1. Remember check your draft version form !

1. Remember check your draft version form !

This is very important,when your form was submitted,we unable to make any changes,For those really needing an amendment, you need to submit another form and past your every document to IRB officer for tax audit purpose! If got any mistake, the penalty will imposed!Thus, remember check twice!!

✔ 2. If everything is correct, click sign and fill in your ID and password. Hollahh, you have done your tax declaration

Online Income Tax Payment

For those who are tax payable, you may clickhttps://bit.ly/3s5kYi6 IRB official payment website to make payment.

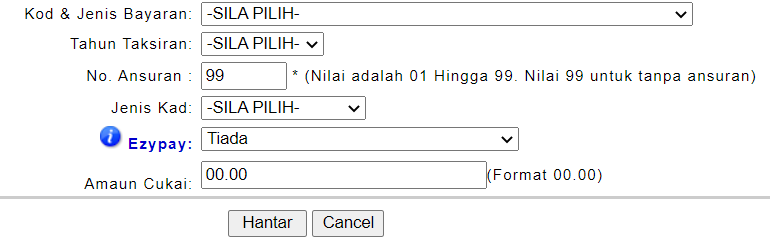

Fill in your I/C number, and fill in : -

Kod & Jenis / Code : 084 – Bayaran Ansuran Cukai/Baki Cukai – Individual

Tahun Taksiran : 2020 (Year of Form BE, refer form page one top right corner)

Bilangan Ansuran : 99

Amount: (Fill in your tax payable)Please aware the format of payment is 00.00,double check to avoid any wrong payment.

*Please print out and keep your income tax form securely after submmision.

还是不明白如何呈报自己的个人所得税吗?还是觉得害怕会填错,觉得步骤繁杂还是根本没有时间呢?为何不让专业的来呢。让我们帮你剩下你的时间。欢迎点击下方联络我们做出安排或了解。